Several eCommerce businesses are increasingly adopting flexible payment solutions – understanding customer needs and demands. Because in today’s digital world of Apple Pay and UPI solutions – a rigid approach toward payment solutions costs businesses a huge deal of sales, customers, and lost revenue.

48% of customers prefer online stores that accept multiple payment methods. In addition, Sezzle’s report suggests that the product’s over-cost is the primary reason behind 55% of abandoned carts. Hence, a flexible payment solution can help reduce cart abandonment and improve your store’s sales in these situations.

And one such highly flexible and customer-friendly payment solution that allows your customers on a tight budget to buy the products they want is – Buy Now, Pay Later (BNPL).

BNPL is a perfect payment solution that seamlessly integrates with WooCommerce and doesn’t require customers to pass a credit check or pay interest.

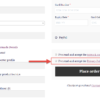

So, in this article, we share the top BNPL solutions to integrate with your WooCommerce store. A growing number of BNPL options, including some of those appearing in this list, can easily be configured through PeachPay, a one-stop-shop checkout & payment solution for WooCommerce stores.

But before we get ahead of ourselves, let’s learn more about this type of payment option and its benefits for your store’s sales and overall growth.

What is Buy Now Pay Later (BNPL) and its importance for your WooCommerce store?

Buy Now Pay Later (BNPL) is one of the fastest-growing eCommerce payment solutions worldwide – and the industry has the potential to generate a transaction volume of approximately $680 billion worldwide by 2025.

BNPL allows your customers to make a purchase and split and pay the amount into monthly installments – instead of paying the entire amount all at once.

Thus, it’s an ideal and attractive payment option, especially for younger consumers – including 40% of the youngest group of millennials that wish to prevent paying credit card interests or racking up debt.

Here are the further benefits of offering BNPL payment on your WooCommerce store:

- Improves conversion rate and sales: BNPL lowers the barrier to purchase – as customers are more likely to purchase if they can pay in installments instead of paying full upfront.

The product’s price should be the last reason for cart abandonment. BNPL shows customers an affordable payment option and makes them immediately complete the purchase with no second thoughts – increasing conversion rates and average order value.

- Customers appreciate payment choices: Multiple payment choices make customers feel empowered and communicate your effort to make purchases as easy as possible for your customers.

Thus, offering a BNPL choice encourages repeat customers, results in positive word-of-mouth, and reduces checkout friction for your customers.

- Customers spend more money: BNPL is a win-win solution for you and your customers. Customers get what they want without lump-sum payments, and you can charge more for products with monthly payment options.

For instance, customers will hesitate to spend on an $800 course and easily pay for the same course with 10 payment installations of $89 each month. Thus, with BNPL, customers spend more money – paying the larger price for an extended period and avoiding the higher one-time cost.

- Reduces payment fraud risks: Choosing a reliable BNPL payment provider reduces the risks of payment fraud as the BNPL company handles the installment payments for your WooCommerce store.

Thus, the BNPL provider pays you out money and takes care of issues and common payment problems – including customers failing to complete the remaining payments, chargebacks, and expired credit cards.

- Provides marketing exposure to your business: BNPL companies maintain directories of each of their merchants.

Thus, partnering with a BNPL provider will allow your store to appear in their shopping directory – accelerating your marketing momentum and making it easier to win new customers.

Thus, if you sell expensive or high-value products – BNPL is especially the perfect solution for your WooCommerce store. So, let’s look at the top BNPL payment solutions that allow you to ensure customer satisfaction, higher conversions, and increased revenue.

Top Buy Now Pay Later solutions for WooCommerce

WooCommerce – Affirm Payment Gateway

Affirm provides tailored Buy Now Pay Later solutions and credit-card-based payment services.

It partners with over 102,000 retailers to remove price as a purchase barrier, turn browsers into customers, increase average order value, and expand your WooCommerce store’s customer base.

Unlike other BNPL solutions, Affirm allows your customers to spread payments and pay in installments over a longer period of up to 36 months for higher-value products with 0-30% for the same.

Its toolkit makes implementing the best-in-class Affirm marketing across multiple channels a breeze and offers omnichannel integrations, including an in-store and an online store. In addition, it also provides access to an engaged network and direct integration assistance – making it easy to take your site live in no time.

Top feature: Affirm provides the maximum approval rates – approving 20% more customers and conversion lift than its competitors, meaning more customers purchasing your products.

Pricing: Free

WooCommerce – Afterpay

Afterpay is an excellent WooCommerce BNPL solution that allows your customers to purchase products over four interest-free installments – each payment every 2 weeks. In addition, it doesn’t come with any application fees or external credit checks – as long as the customer pays the entire amount.

Affirm minimizes and takes on risks – including fraud and chargebacks, allowing you to focus on growing your core business and WooCommerce store. Its Express Checkout streamlines the customer checkout experience and ensures higher conversions by eliminating 5 steps and 40 customer information fields.

It has both an app and an online shopping portal and is a popular solution for huge retailers – including Urban Outfitters, Free People, and Sketchers.

Its other excellent features include Cross Border Trade to sell products internationally, Ai-powered risk to approve over 90% of customer-attempted transactions, and Afterpay Business Hub – a portal with your store’s insights and performance.

Top feature: Provides daily settlement reports and transactional information, which you can use to verify and reconcile orders.

Pricing: Free

WooCommerce – Klarna Checkout

Klarna Checkout is a complete WooCommerce checkout, and payment solution besides Buy Now Pay Later – it embeds several other popular payment solutions, including installments and financing.

It provides a smooth purchase experience for your customers by providing multiple payment options. In addition, it also seamlessly manages multiple transactions, including APMs and cards.

With BNPL, Klarna Checkout allows your customers to pay the amount within 14, 20, and 30 days. In addition, it allows your customers to spread the purchase cost with monthly payments – with or without interest.

Klarna Checkout is an excellent all-in-one payment solution that helps increase your average order value, gain new customers, minimize fraud risks, and track your store’s performance with its aggregated daily sales overview.

Top feature: Klarna Checkout offers a mobile-optimized customer checkout experience and provides one-click repeat purchases – identifying repeat customers and improving customer satisfaction and sales.

Pricing: Free

WooCommerce – Klarna Payments

While Klarna Checkout is a complete all-in-one payment method – Klarna Payments is a standalone payment solution that allows you to choose a relevant payment and complement it with your existing checkout process with its hosted widget.

You can choose between Buy Now Pay Later in full, Slice it (long-term monthly payments), direct payments, and pay later in installments. Thus, offering Klarna’s unique payment options – boosts their purchasing power, provides an intuitive customer experience, increases loyalty, and improves the average order value.

Overall, Klarna Payments is a globally-compliant BNPL solution that absorbs all credit risks and frauds and provides valuable customer insights – allowing you to track and analyze your performance.

Top feature: Its easy-to-integrate on-site messaging feature provides customers eligibility checks and tailored and personalized messaging – allowing them to learn more about their financing and payment options before proceeding to the checkout.

Pricing: Free

Codecanyon – WooCommerce PostPaid – Buy Now Pay Later

WooCommerce PostPaid’s Buy Now Pay Later solution allows your customers to purchase products they want – paying up to the limit you set on the products and clearing their dues later.

You’re free to set any PostPaid balance limit for your customers – eliminating customers’ risk of postponing purchases due to insufficient funds. In addition, it encourages on-the-spot customer purchases and reduces the chances of cart abandonment.

However, unlike other BNPL solutions – your customers need to upload their verification documents to apply for the postpaid feature and pay for the products later. In addition, you can also set the document verification status as eligible, pending, and rejected – after thorough checking and verification.

Moreover, it also allows you to permit re-uploading of the documents for your customers. And both you and your customers can easily view all the postpaid-related transactions, details of a particular transaction, and the customer’s postpaid balance. You can enable or disable this payment function anytime you need it for your customers.

One of the most unique and excellent features of this BNPL solution is that it holds Envato’s WP Requirements Compliant Badge award as it meets all the WordPress quality standards – including performance, security, quality, and modern coding standards.

WooCommerce PostPaid is a multilingual BNPL payment solution that adds WooCommerce Email templates for postpaid-related emails and supports postpaid refunds to ensure quality and a smooth customer experience.

Top feature: WooCommerce PostPaid allows you to charge interests to your customers on the PostPaid transactions – allowing you to increase your store’s net revenue.

Pricing: The Regular License costs $45, while the Extended License costs $225.

Sezzle

Sezzle is a reliable and excellent Buy Now Pay Later payment tool that allows you to easily break up large and high-value products into multiple installments for your customers. It charges 0% interest to your customers and allows you to spread payments in 4 installments over 6 weeks.

Moreover, Sezzle also supports instant approval decisions to approve a maximum number of customer transactions and encourage more customers to buy from your WooCommerce store. Besides seamlessly integrating with WooCommerce – Sezzle also offers other eCommerce integration, including Magento, Shopify, Wix, and BigCommerce.

In addition, Sezzle has over 1 million active customers and 10,000+ merchants and provides you with access to an engaged community of network – helping you build your store’s brand and awareness.

Thus, Sezzle is a Zero-risk BNPL solution with no hidden fees, doesn’t issue credit reports, assumes full credit risk, and allows you to receive payments upfront in no time instantly. It also helps boost your average order value by 20% and increase repeat purchases by 10%.

Top feature: Since it charges 0% interest, Sezzle doesn’t impact your customer’s credit scores and doesn’t demand any credit – removing purchasing friction, pricing barrier, and ensuring a great customer experience.

Pricing: You need to request a demo for pricing

Conclusion

Offering flexible pricing and payment solutions is one of the top priorities of many eCommerce stores and online businesses.

And Buy Now Pay Later is one of the best and most widely adopted payment options that enable your customers to instantly purchase higher-value products and pay for them over weekly or monthly installments – especially enticing younger consumers.

In fact, last year, in 2021 – over 26% of millennials and 11% of Gen Z consumers used the BNPL payment option for their eCommerce purchases. Thus, customers increasingly rely on flexible digital payment solutions instead of the good old credit cards.

So, if you wish to offer the best shopping experience to your customers through flexible pricing, increase the average order value, boost conversions and revenue, and reduce payment frauds. In that case, check out the top BNPL solutions mentioned above and choose a suitable option that best matches your budget and specific requirements.

And if you want to manage your BNPL options in one place, use PeachPay to configure them alongside other payment options, such as Stripe, PayPal, Google Pay, and Apple Pay. PeachPay also promises to roll out more payment analytics over time so you can get data about which gateways, wallets, and BNPLs are actually being used on your store!