Payments on your eCommerce store are the most important touchpoint between your customers and business sales. Hence, an optimum payment solution that’s seamless, quick, and secure plays a critical role in ensuring a quality customer experience.

Over 17% of customers abandon their carts because of concerns with payment security, and 13% abandon them because the price is in a foreign currency. Thus, it’s vital to choose a payment method that accepts global currencies and ensures a secure checkout – while making the checkout process easy for your customers.

However, from including digital wallets to third-party payment solutions and managing transactions – choosing a suitable payment solution that facilitates this process for your WooCommerce store can get challenging. This is where WooCommerce Payments comes into the picture.

In early May 2020, WooCommerce released its new version WooCommerce 4.1, with two new features – including WooCommerce Payments, which provides a simplified way to accept and manage payments in your store.

This article shares more about WooCommerce Payments, their pros and cons, and an easy way to enable them on your WooCommerce store.

WooCommerce Payments: what is it, and how does it work?

WooCommerce Payments – exclusively developed for WooCommerce users, is a payment processing solution that facilitates processing online business transactions right from your WooCommerce dashboard.

It’s a fully integrated solution that streamlines your checkout process, allows you to accept payments in 135+ currencies and enables customers to pay in your store in their preferred currency directly.

WooCommerce Payments lets you accept major debit and credit cards – providing an option to your customers to save the card details for faster future checkouts. Besides, you can also accept in-person payments through the M2 card reader and WooCommerce Payments (only available for U.S.-based stores).

Apart from collecting payments – this integrated payment solution also makes it easier to manage recurring business revenue and refunds, track cash flow, handle disputes, monitor changes, and track deposits from your store’s backend dashboard. Such simplified management makes handling global payments a breeze and leaves you more time to focus on your business’s growth.

Moreover, it also lets you accept digital wallet payment services – including Apple Pay to enable 60% faster checkout and improve conversion rates in your store.

Top feature: It automatically deposits your balance to your nominated bank account on a two-day rolling basis – allowing you to accept your earnings faster. Additionally, if you’re an eligible merchant – you can immediately access your funds through Instant Deposits at a 1.5% payout cost (only applicable for U.S.-based store owners).

Pricing: It’s free to install and requires no monthly or setup fees. However, it requires you to pay a transaction fee of 2.9% + $0.30 on a pay-as-you-go basis.

Pros of using WooCommerce Payments

WooCommerce Payments provides all the essential features like third-party payment gateways and more.

Here are some of the excellent pros of using WooCommerce Payments for your store:

- Stripe powers it: Stripe, one of the most popular payment gateways, powers WooCommerce Payments. Thus, it doesn’t require you to redirect your customers to other third-party payment websites.

- Seamless integrations: WooCommerce Payments seamlessly integrates with WooCommerce Subscriptions – empowering you to run subscription-based services on your WooCommerce store and earn recurring revenue. You can easily activate, cancel, or suspend one or more subscriptions whenever needed.

In addition, its excellent built-in subscription functionality provides you with free access to the features and greater flexibility to sell subscriptions online and grow your business.

- Integrated analytics: With WooCommerce Payments’ integrated analytics – you can analyze key insights and metrics related to finances, traffic, SEO, and conversion to understand your customer’s preferences better and take actionable steps.

- Simplified workflow: You no longer have to log into third-party payment processor websites (PayPal or Stripe) with WooCommerce Payments – and manage all the payment aspects from the comfort of your dashboard.

With fewer passwords to remember and fewer accounts to manage – WooCommerce Payments significantly simplifies the payment workflow for your store.

- Improves customer experience: WooCommerce Payments eliminates the complexity and reduces the duration of checkout for your customers – allowing customers to directly pay on your WooCommerce store without being redirected to a third-party checkout page.

- Reduces cart abandonment: The faster, streamlined, and seamless customer checkout potentially results in more sales and fewer cart abandonments than a multi-page website checkout process.

- Increases conversions: Providing global payment options like Apple Pay, giropay, Google Pay, P24, EPS, SEPA, Sofort, Bancontact, BECS, and iDeal improves conversions as 54% of customers feel having a variety of payment options is crucial when checking out online.

Cons of using WooCommerce Payments

WooCommerce Payments makes finance management easy for your online store while empowering you to leverage insights and formulate strategies to improve your store’s profit and payment collection efficiency.

However, despite the incredible benefits that WooCommerce Payments brings to the table – it comes with its own set of challenges. Here are the cons of using WooCommerce Payments:

- Location restriction: WooCommerce Payments is only available in 18 countries currently – including Australia, Germany, the United States, Canada, Spain, and the United Kingdom.

Such exclusion of other important countries and acceptable currencies limits your potential customers’ scope and negatively impacts your store’s conversion and sales.

- Risk of losing data during migration: WooCommerce Payments comes with a risk of losing historical purchase and shopping data when migrating from third-party payment gateways.

Currently, WooCommerce Payments doesn’t support importing critical customer payment data – which is a huge downside as it also means you cannot access historical information to analyze customers’ purchase patterns.

- Only integrates with Stripe: The WooCommerce Payments extension only integrates with Stripe and doesn’t support other third-party payment providers – including PayPal.

- GDPR and security: WooCommerce Payments don’t offer PCI-DSS compliance by default. Thus, as a store owner – you need to file a SOC-1 to ensure PIC-DSS and GDPR compliance of your store.

That being said, let’s look at how to enable the WooCommerce Payments extension on your store to simplify payment collection and management.

Enabling WooCommerce Payments on your WooCommerce store

One of the major selling points of WooCommerce Payments is its ease of installation and setup.

Here, we discuss a simple way to enable the WooCommerce Payments extension on your store. But first, let’s look at the critical requirements for the same.

Requirements to enable WooCommerce Payments

- Registered online business in the supported country

- WooCommerce 4.8+

- WordPress 5.7+

- PHP 7.0+

- An SSL Certificate to use the payment extension in live mode.

Once your WooCommerce store checks all these requirements, follow these steps to enable WooCommerce Payments.

Steps to set up WooCommerce Payments on your store

Setting up WooCommerce Payments on your store is easy and only takes a few minutes.

If WooCommerce Payments supports your preferred currency and you have your WooCommerce store backed by a registered business entity – you can download the free WooCommerce Payments plugin as a file from the official WooCommerce extensions store on your device.

Once you download the WooCommerce Payments extension – here are the steps you need to follow to set up the plugin.

Step 1 – Installation and Activation of WooCommerce Payments

Follow these steps to activate WooCommerce Payments on your store.

- Login to the WordPress site and access your WordPress dashboard.

- Go to Plugins and select Add New from the displayed options in the dashboard.

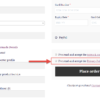

- Now, search for WooCommerce Payments:

- Then, click on ‘Install Now’ from the drop-down menu, and you’ll get a “plugin installed successfully” notification after successful installation of the plugin.

- Next, click on the Activate Plugin button at the bottom of the same page.

Step 2 – Get started and connect your WordPress site to WooCommerce Payments

After successfully installing the plugin – you need to connect your WordPress website to WooCommerce Payments to use the extension successfully. Simply follow the prompts on your screen to connect to your WordPress site.

- Click on the Payments tab on the left-hand menu bar.

- Here, select Set Up for the details verification process.

- Then, enter the email address that’s associated with your WordPress site.

- Click on the Continue button.

These steps connect the WooCommerce Payments plugin to your eCommerce store.

Step 3 – Complete the verification process

The screen will prompt you to enter some basic business verification details to verify your store’s connection to WooCommerce Payments.

Fill in all the necessary fields in the verification form for the Stripe payment gateway – including type of entity, mobile number, and email, and click on the Next button.

It’ll take you to the WooCommerce Payments settings screen. Here, you can select the Enable WooCommerce Payments to start accepting direct credit and debit card payments in your store.

In addition, you can also enable the express checkouts option to allow your customers to checkout via Apple Pay, Google Pay, or Stripe Link. You can also configure other settings – including transactions and deposits, multi-currency, card readers, and advanced settings.

Finally, save all the changes – and your WooCommerce store is now ready to accept payments via WooCommerce Payments.

Conclusion

Choosing and setting up a cohesive payment gateway solution on your WooCommerce store might seem a huge job to tackle, but integrating the official WooCommerce Payments plugin with your store will ease your payment workflow, provide an excellent checkout experience and make tracking and managing finances a breeze.

However, while it seems like a feasible solution – WooCommerce Payments doesn’t provide all the functionalities required for international transactions, security, and data integrity. Thus, you can use WooCommerce Payments as a good supplementary option with third-party gateways like PayPal and Stripe, which are available in 40+ countries, offer PCI-DSS compliant checkout and detailed financial reporting.

Or, better yet – you can also leverage PeachPay for a one-click, frictionless, and 3D secure card payment checkouts for your store. These solutions are far more customizable, secure, and global than WooCommerce Payments.

It’s best to analyze your eCommerce store’s requirements and opt for a payment gateway solution that best suits your business goals and customer expectations.